The Weekly Blend #166 - ASML și TSMC dau tonul sezonului de raportări

Băncile se bucură de un mediu economic prielnic, frica de bulă AI se intensifică pe internet, Trump se va întâlni cu Putin în Budapesta, Broadcom, un nou partener OpenAI, OpenAI și pornografia

Salut,

Primești această ediție gratuit, direct la tine în inbox, în fiecare săptămână. Ca să mă ajuți să o țin în viață nu trebuie decât să o împarți cu prietenii tăi, așa că folosește butonul de mai jos fără frică 👇

🙌Fii și tu sponsor al newsletter-ului și poți să ajungi la peste 2k oameni care îl citesc săptămânal. Newsletter-ul e gratuit, dar informațiile sunt neprețuite💎, așa că dă de veste prietenilor tăi ca să le faci un bine și dacă vrei ca produsul sau serviciul tău să fie mai vizibil, trimite-mi un mail pe adresa contact@laurentiuvana.ro și hai să discutăm!🤗

Nu uita, cel mai bun prieten al tău pentru investiții este XTB!

Noutăți!

Am pentru tine mai multe resurse gratuite pe care le găsești în secțiunea Resurse gratuite pe blog-ul meu, laurentiuvana.ro. Pe lângă mini cursul care te va ajuta să te apuci de investiții, poți să ai acces la:

Calculatoare de tip simulator care îți arată cum să investești dacă vrei să te pensionezi în 10 ani sau vrei să îi cumperi copilului tău un apartament la 18 ani;

Calculator de preț corect al companiilor listate la bursă, 100% automatizat;

Aruncă un ochi pe blog pentru noi articole

Dacă ai un feedback sau crezi că ar fi util să mai fac și alte calculatoare/ simulatoare, lasă un comentariu mai jos!

Ce ne spune macro-economia💶

Mereu ne raportăm la un etalon, facem comparații, de aia apelăm la review-uri și opinii ale oamenilor. Indicatorii de mai jos sunt ca review-urile de pe eMag, te ajută să decizi dacă e un moment bun să investești, dacă te angajezi la McDonalds🍔 sau îți iei Lamborghini🏎 la final de săptămână.

Ai cei mai mari indici bursieri, SP500, Nasdaq, Dow Jones și cele mai importante mărfuri precum petrolul🛢, gazul natural🔋, aurul👑. Pe lângă asta, băncile o mai iau razna, crizele mai apar, oamenii se panichează, așa că e bine să fim pregătiți și te ajut că cele mai des folosite indicatoare, dobânzile pentru obligațiunile de stat, indicele de volutatilitate (VIX) și faimoasele indicatoare de frică și lăcomie (există și un serial despre asta), atât pentru Bitcoin, cât și pentru SP500.

📊 Piața sub lupă: Volatilitate și scăderi

Raportări financiare (1W) 🔻

După turbulențele recente, indicii bursieri au reușit să încheie săptămâna pe un ușor plus, indicând o stabilizare a pieței de acțiuni.

🟢 INDU (Dow Jones): 46,190.61 (↑ +0.27%)

🟢 NDX (Nasdaq 100): 24,817.95 (↑ +0.27%)

🟢 SPX (S&P 500): 6,664.01 (↑ +0.14%)

Concluzie: O creștere modestă, dar generală, pe toți indicii. Piața a absorbit șocul săptămânii trecute și pare să caute o bază de consolidare. 👍

Evoluția altor active cheie 🥇⛽

Aurul a atins un nou maxim, în timp ce materiile prime energetice continuă să scadă.

🟢 XAUUSD (Aur): 4,305.37 (↑ +4.70%)

🔻 CO1 (Petrol Brent): 61.13 (↓ -3.50%)

🔻 NG1 (Gaz natural): 3.00 (↓ -3.31%)

Concluzie: Creșterea masivă a Aurului peste 4.300 USD/uncie arată că investitorii continuă să vadă metalul prețios ca pe o asigurare esențială împotriva riscurilor. Scăderile la Petrol și Gazul Natural pot semnala o încetinire economică sau o ofertă mai mult decât suficientă.

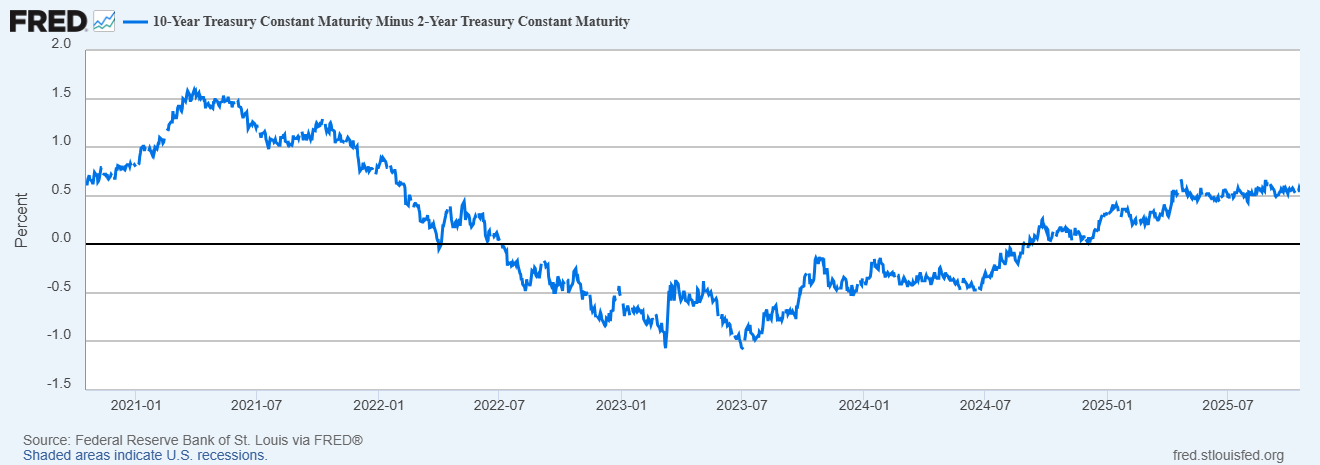

Dobânzi și volatilitate 🔍

🟢 VIX (Volatilitate): 20.75 (↑ +9.04%)

🔻 US10Y (Randament 10Y): 4.000% (↓ -1.31%)

🔻 US2Y (Randament 2Y): 3.466% (↓ -1.25%)

Concluzie: Deși indicii au crescut, VIX (indicele “fricii”) a urcat din nou, menținându-se ferm peste pragul de 20. Aceasta indică faptul că temerile investitorilor rămân ridicate, în ciuda performanței pozitive a acțiunilor. Randamentele obligațiunilor pe 10 ani și 2 ani au scăzut, sugerând o înclinație către instrumente mai sigure.

Ce urmărim în continuare: 🔭

Aurul (XAUUSD): Dacă va reuși să mențină acest nivel istoric de peste 4.300 USD.

Volatilitatea (VIX): Dacă VIX se menține peste 20, ne putem aștepta la mișcări bruște în piață, în ciuda creșterii indicilor.

Petrolul (CO1): Urmărim dacă prețul va testa pragul psihologic de 60 USD/baril.

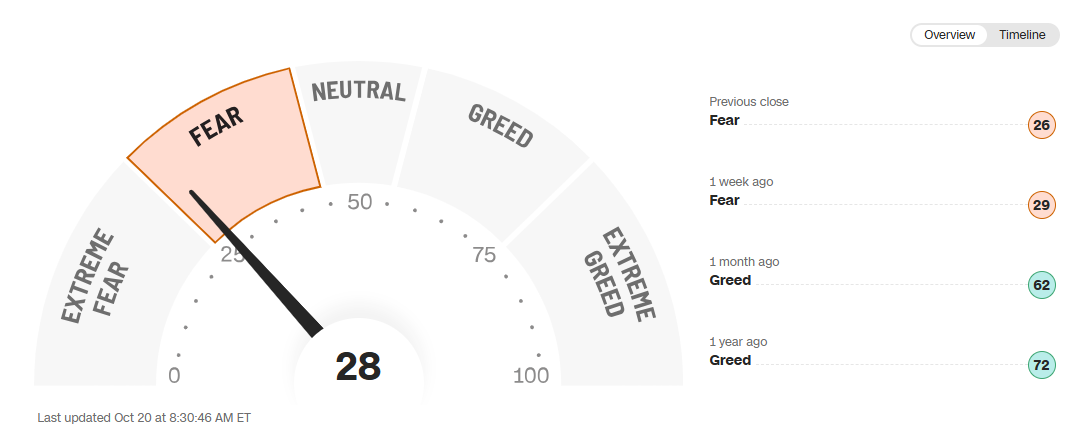

Fear & Greed Index SP500 😁/ 😤

Fear & Greed Index BTC😁/😤

Dacă te ajută, lasă și un comentariu ca eu să știu că ești mulțumit!👇

Pulsul pieței 🤑

Salutare!

Dacă mai ai poftă de informații, poți oricând să urmărești canalul meu de Youtube și contul de Instagram. Postez des și mereu vei găsi informații noi și diferite de cele din newsletter.

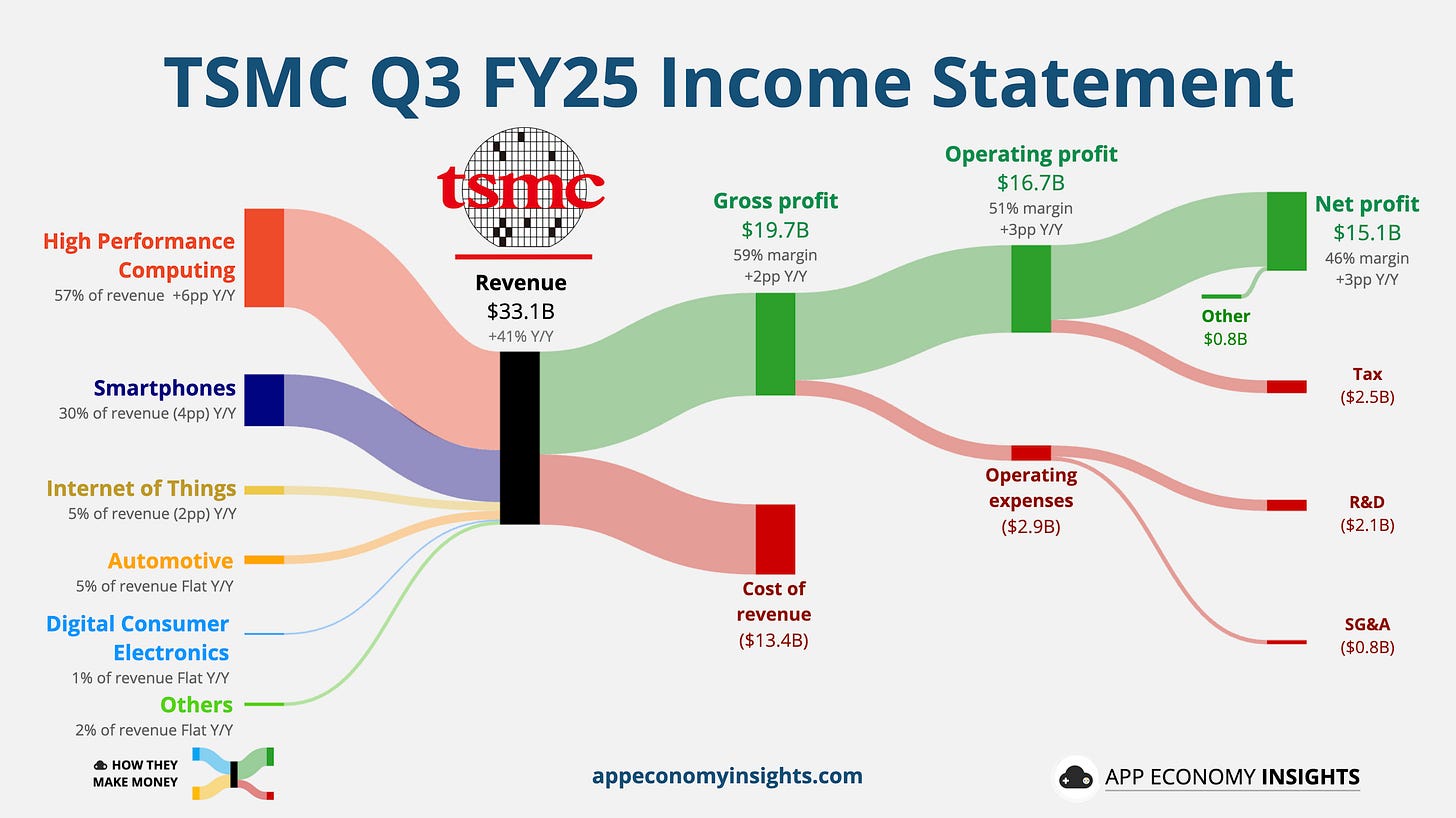

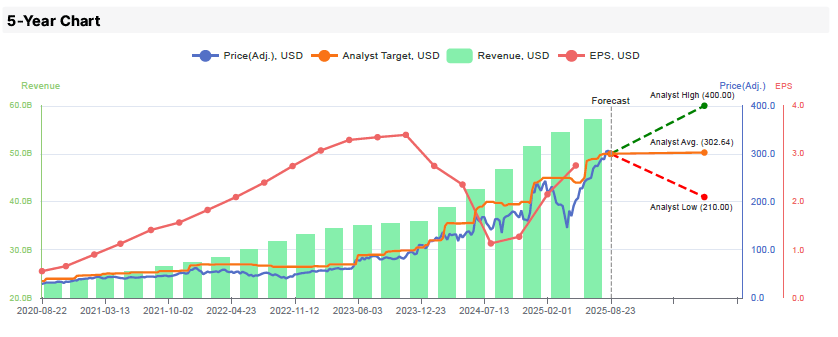

📊 TSMC T3 2025, AI alimentează rezultatele financiare

Taiwan Semiconductor Manufacturing Company (TSMC), cel mai mare producător de semiconductori pe bază de contract din lume, a raportat rezultate financiare excepționale pentru al treilea trimestru al anului 2025, depășind așteptările și consolidându-și poziția de lider într-o industrie aflată în plină expansiune datorită inteligenței artificiale (AI). Compania a înregistrat creșteri semnificative ale veniturilor și profitului, susținute de cererea robustă pentru tehnologiile sale de proces avansate, în special cele de 3nm și 5nm. Perspectivele pentru finalul anului rămân solide, TSMC majorându-și estimarea de creștere a veniturilor pentru întregul an 2025

Rezultate financiare

Venituri nete totale: 989,92 miliarde NT$ (+6,0% față de trimestrul anterior (QoQ), +30,3% față de anul precedent (YoY)). Veniturile în dolari SUA au fost de 33,10 miliarde $, în creștere cu 10,1% QoQ și 40,8% YoY.

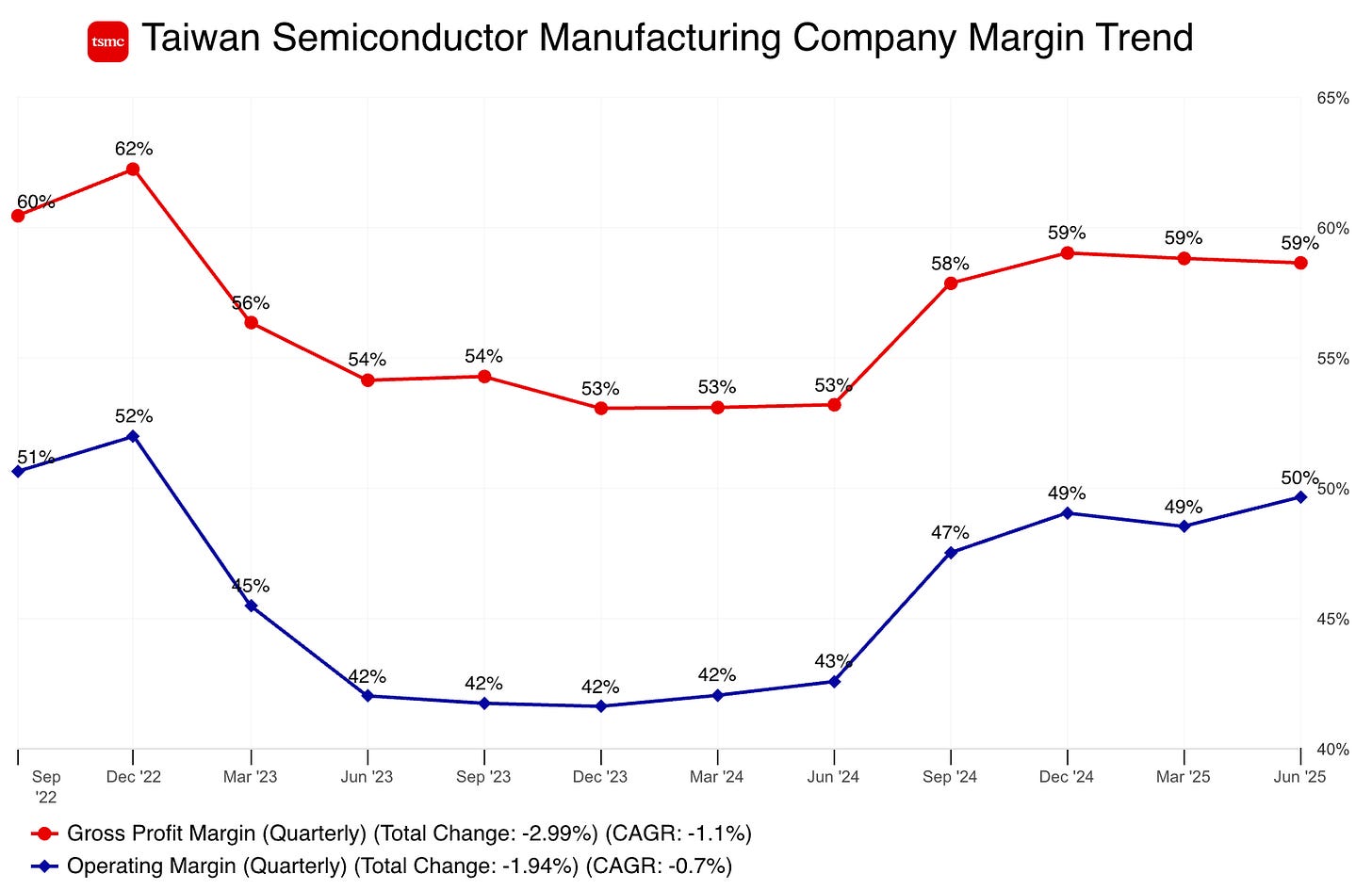

Marja brută: 59,5%, în creștere cu 0,9 puncte procentuale față de T2 2025 și 1,7 puncte procentuale față de T3 2024. Depășește ghidajul anterior.

Marja operațională: 50,6%, în creștere cu 1,0 punct procentual QoQ și 3,1 puncte procentuale YoY.

Profit net (atribuibil acționarilor): 452,30 miliarde NT$, în creștere cu 13,6% QoQ și 39,1% YoY.

Profit pe acțiune (EPS Diluat): 17,44 NT$, în creștere cu 13,6% QoQ și 39,0% YoY.

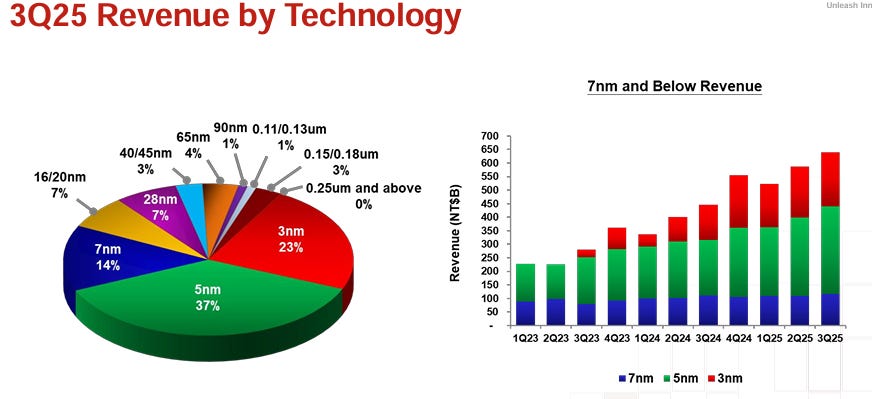

Contribuția tehnologiilor avansate (≤7nm): A reprezentat 74% din veniturile totale din wafer.

3nm: 23% din veniturile din wafer.

5nm: 37% din veniturile din wafer.

7nm: 14% din veniturile din wafer.

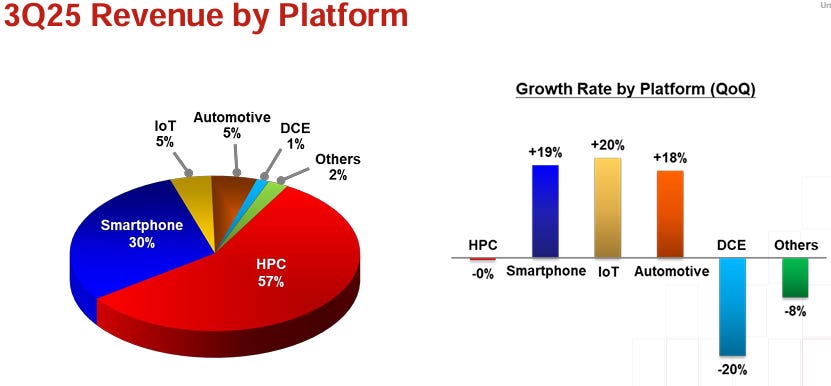

Venituri pe platformă:

Calcul de înaltă performanță (HPC): 57% (stabil QoQ).

Smartphone: 30% (+19% QoQ).

IoT: 5% (+20% QoQ).

Automotive: 5% (+18% QoQ).

Puncte cheie

Creștere robustă susținută de tehnologiile avansate: Veniturile TSMC au continuat să crească solid, depășind pragul de 33 miliarde USD în T3. Această performanță a fost alimentată de cererea puternică pentru cele mai avansate noduri de procesare ale companiei, 3nm și 5nm, care împreună au generat 60% din veniturile din wafer. Ponderea tehnologiilor avansate (definite ca 7nm și mai jos) a atins 74%, subliniind rolul critic al TSMC în furnizarea de cipuri de ultimă generație.

AI - motorul principal al cererii: Segmentul HPC a rămas cel mai mare contributor la venituri (57%), reflectând investițiile continue în infrastructura AI. Cererea legată de AI este descrisă de CEO-ul C.C. Wei ca fiind “robustă” și chiar “mai puternică decât am crezut acum trei luni”. Creșterea “explozivă” a volumului de token-uri în modelele AI de consum necesită tot mai multă putere de calcul, stimulând cererea de semiconductori de vârf. De asemenea, adopția AI în companii (Enterprise AI) și inițiativele guvernamentale (Sovereign AI) contribuie la această tendință pe termen lung. Compania primește “semnale foarte puternice” direct de la clienții clienților săi, care solicită capacitate. Rata de creștere anuală compusă (CAGR) pentru acceleratoarele AI ar putea fi chiar mai bună decât estimarea anterioară de “mid-40s” %.

Profitabilitate solidă și managementul costurilor: Marja brută a crescut la 59,5%, depășind ghidajul anterior, datorită eforturilor de îmbunătățire a costurilor și unei rate mai mari de utilizare a capacității. Aceasta a compensat parțial impactul nefavorabil al cursului de schimb și diluția cauzată de fabricile din străinătate. Marja operațională a atins, de asemenea, un nivel impresionant de 50,6%. Diluția marjei brute din cauza fabricilor din străinătate este acum estimată la 1-2% pentru 2025 (în scădere de la 2-3%) , dar se așteaptă să crească la 2-3% și ulterior 3-4% în următorii ani.

Investiții strategice și expansiune globală: TSMC își ajustează planurile de investiții pentru a răspunde cererii AI. Intervalul pentru cheltuielile de capital (CapEx) în 2025 a fost restrâns la 40-42 miliarde USD. Aproximativ 70% din acest buget este alocat tehnologiilor avansate, iar restul pentru tehnologii speciale și ambalare avansată. Compania progresează cu extinderea în Arizona (SUA), unde ia în considerare achiziționarea de teren suplimentar pentru un cluster GIGAFAB și accelerează upgrade-ul tehnologic către N2+ datorită cererii AI. Prima fabrică din Japonia a început producția de volum , iar construcția celei de-a doua a demarat. Construcția a început și în Dresden, Germania. În Taiwan, investițiile continuă în N2 și ambalare avansată.

Avans tehnologic continuu (N2, A16): Tehnologia N2 (2nm) este pe cale să intre în producția de volum mai târziu în acest trimestru (T4 2025), cu o accelerare a producției așteptată în 2026, susținută atât de smartphone-uri, cât și de aplicații HPC/AI. TSMC a introdus și extensia N2P (producție în a doua jumătate a anului 2026) și noua tehnologie A16 (cu Super Power Rail, producție în a doua jumătate a anului 2026), destinată produselor HPC specifice.

Perspective

Venituri între 32,2 și 33,4 miliarde USD (reprezentând o scădere secvențială de 1% sau o creștere YoY de 22% la mijlocul intervalului).

Marja brută între 59% și 61%.

Marja operațională între 49% și 51%.

Pentru întregul an 2025, TSMC și-a îmbunătățit prognoza, așteptând acum o creștere a veniturilor în dolari SUA “aproape de mijlocul intervalului 30%” (close to mid-30s percent) față de 2024.

Concluzie

TSMC a livrat un nou trimestru remarcabil, demonstrând capacitatea sa de a capitaliza pe mega-trendul AI. Cererea pentru tehnologiile sale de vârf este extrem de puternică, iar compania investește agresiv pentru a-și extinde capacitatea globală și a-și menține avansul tehnologic cu noduri precum N2 și A16. Deși există incertitudini macroeconomice și geopolitice (inclusiv potențialul impact al tarifelor ), perspectivele pe termen scurt și mediu rămân foarte pozitive. TSMC este poziționată ideal pentru a beneficia de creșterea structurală generată de AI și HPC, rămânând un pilon esențial al industriei globale de semiconductori

Mereu să faci un calcul de fair value și nu uita că găsești un calculator gratuit din partea mea chiar pentru asta. Îl ai aici.

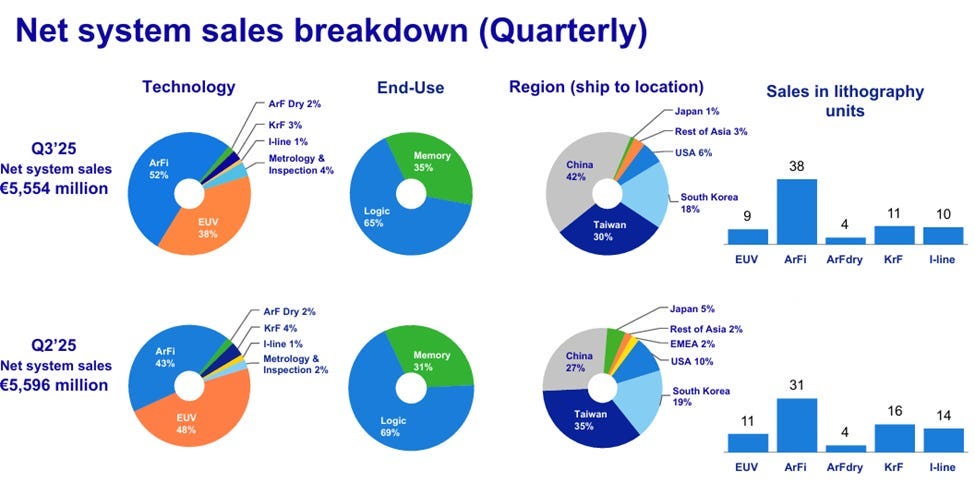

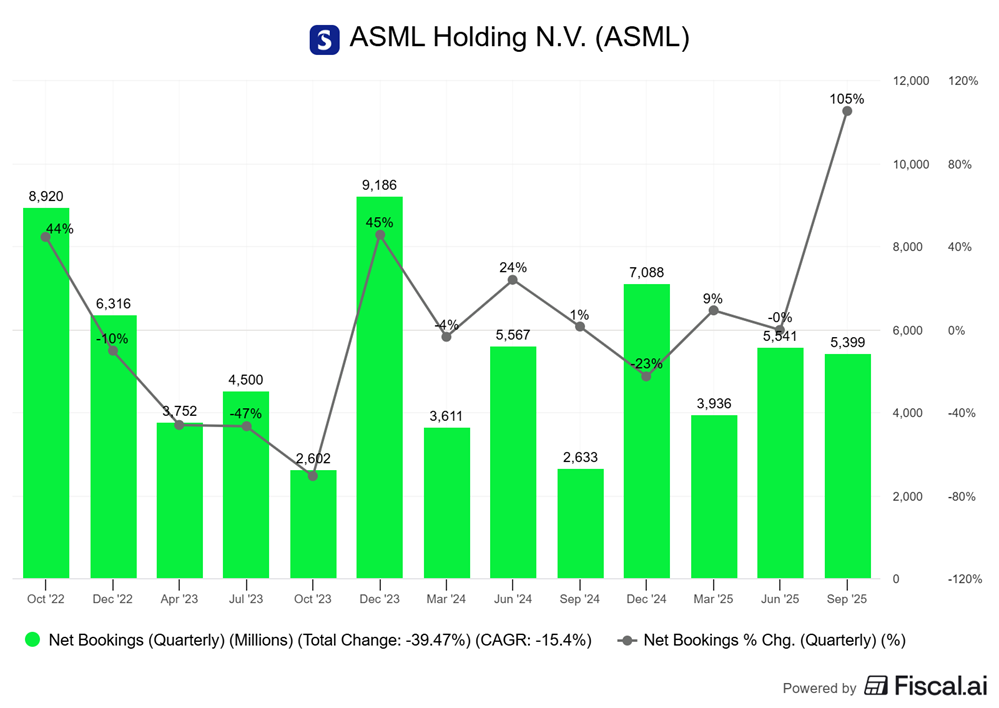

📊 ASML T3 2025, motorul inovației

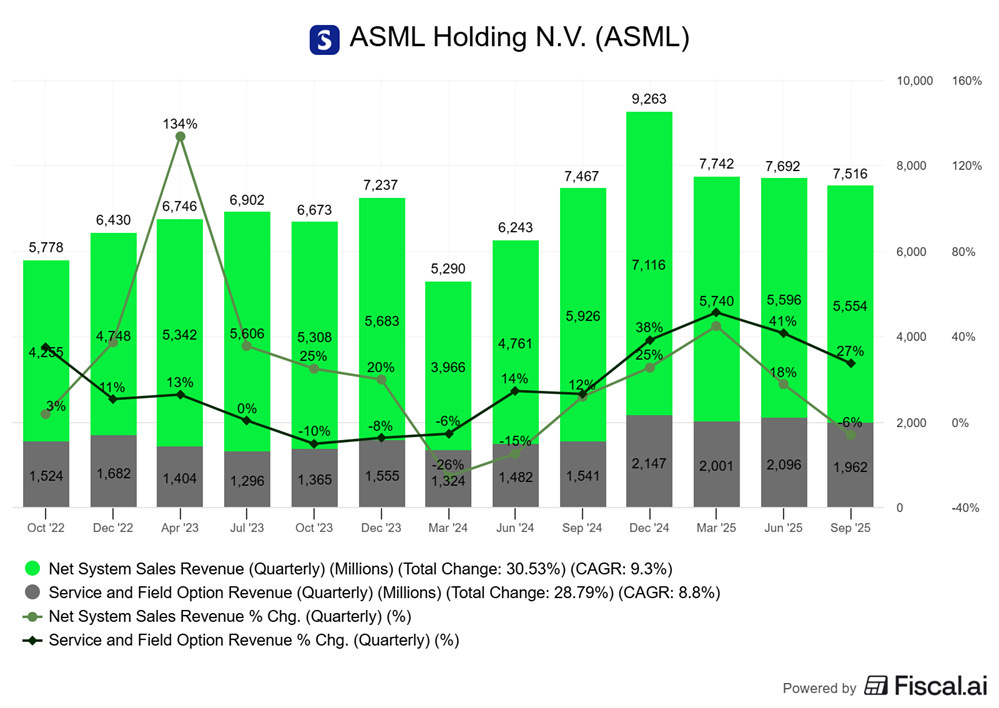

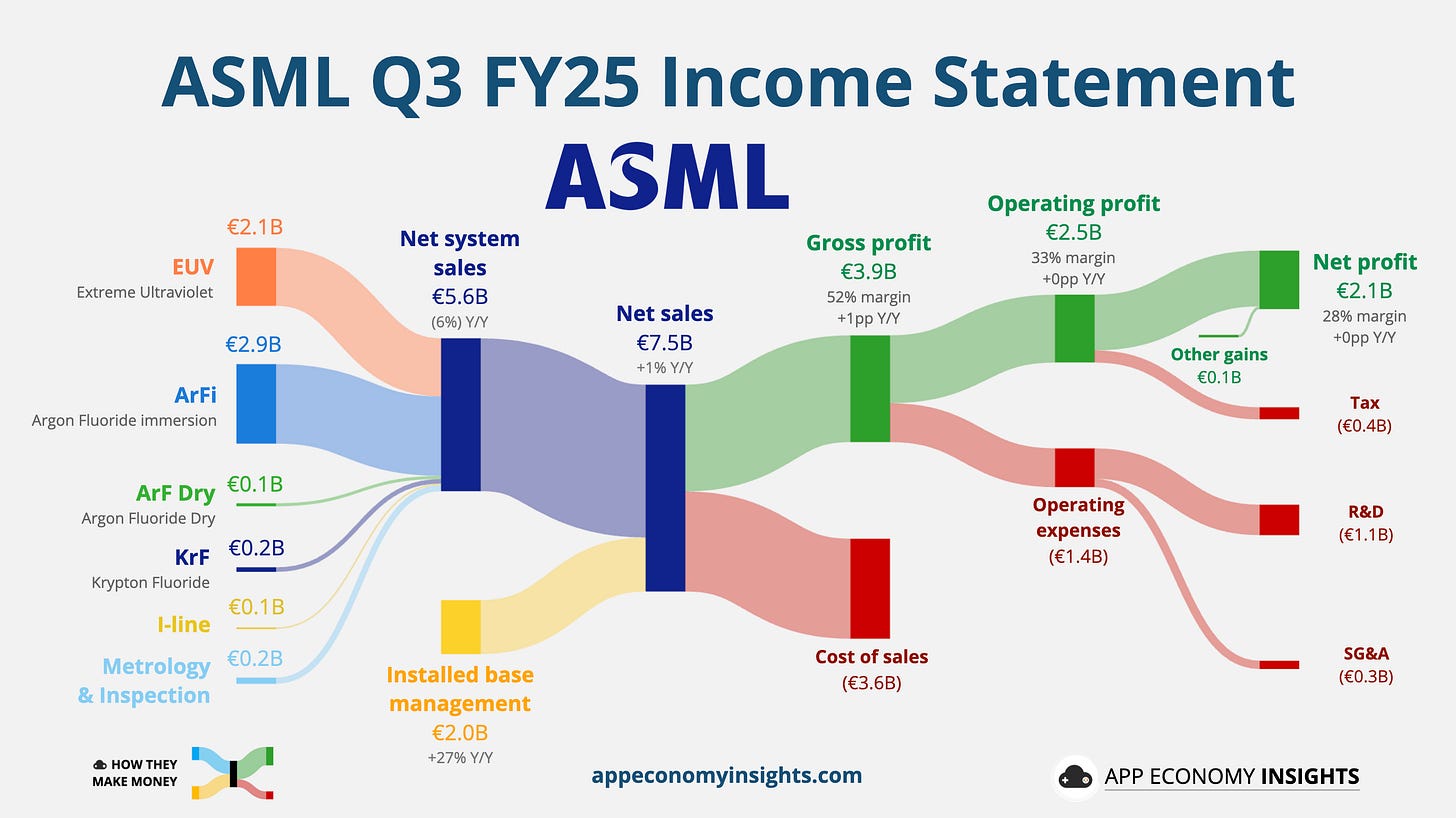

ASML, cel mai important furnizor strategic din lanțul de aprovizionare al semiconductorilor, a raportat rezultate pentru al treilea trimestru al anului 2025 care s-au aliniat cu previziunile. Deși creșterea veniturilor a fost modestă, adevărata “poveste” a trimestrului constă în comenzile nete de 5,4 miliarde de euro, determinate în mare parte de cererea pentru infrastructura AI. Acest impuls puternic al comenzilor a compensat îngrijorările investitorilor legate de veniturile pe termen scurt. Cu toate acestea, optimismul a fost temperat de un avertisment clar al conducerii: vânzările către China, o piață majoră, vor scădea semnificativ în 2026 din cauza limitărilor de reglementare.

Rezultate financiare

Venituri nete totale: 7,5 miliarde € (7.516,0 milioane €), o creștere de aproximativ 0,7% față de 7.467,3 milioane € în T3 2024.

Venit din exploatare: 2,5 miliarde € (2.468,4 milioane €), o creștere de 1,1% față de 2.441,2 milioane € în T3 2024.

Profit net: 2,1 miliarde € (2.124,5 milioane €), o creștere de 2,3% față de 2.076,5 milioane € în T3 2024.

Marja brută: 51,6%, în scădere față de 53,7% în trimestrul al doilea al anului 2025, dar în creștere față de 50,8% în T3 2024.

Comenzi nete (Net Bookings): 5,4 miliarde € (5.399 milioane €), o creștere semnificativă față de 2.633 milioane € în T3 2024.

Puncte cheie

Un trimestru conform așteptărilor, cu o scădere a marjei Vânzările nete totale ale ASML în T3, de 7,5 miliarde €, și marja brută de 51,6% au fost în conformitate cu previziunile companiei, reflectând un trimestru bun. Cu toate acestea, marja brută a înregistrat o scădere de la nivelul de 53,7% din trimestrul al doilea al anului 2025, indicând presiuni pe termen scurt, chiar și în contextul unor comenzi viitoare puternice.

Adevărata “Poveste”: Comenzile determinate de AI Evoluția majoră a trimestrului a fost valoarea noilor comenzi nete, care a ajuns la 5,4 miliarde €. Acest flux robust de comenzi este alimentat în mare parte de cererea pentru mașinile EUV (litografie în ultraviolet extrem) din partea producătorilor de cipuri de ultimă generație. Conducerea a subliniat un “impuls pozitiv continuu în jurul investițiilor în AI”, care se extinde la tot mai mulți clienți, atât în segmentul Logic (procesoare logice) de vârf, cât și în cel de DRAM (memorii) avansate.

Avertisment major privind piața din China în 2026 Conducerea a transmis un avertisment clar: se așteaptă ca cererea clienților din China și, prin urmare, vânzările nete totale ale companiei în China în 2026, “să scadă semnificativ” în comparație cu afacerile foarte puternice înregistrate acolo în 2024 și 2025. Această scădere anticipată este pusă pe seama limitărilor de reglementare.

Schimbarea motoarelor de creștere: Accent pe AI Această dinamică semnalează o schimbare importantă în factorii de creștere ai ASML. Conducerea a subliniat că cererea din afara Chinei – în special din partea fabricilor din S.U.A., Taiwan și Coreea de Sud – se accelerează pe măsură ce cursa pentru infrastructura AI se intensifică. Creșterea viitoare a ASML pare acum ancorată mai mult de expansiunile fabricilor determinate de AI, decât de ciclurile tradiționale ale piețelor de smartphone-uri sau PC-uri.

Perspective temperate pentru 2026 Deși compania se bucură de cererea din AI, avertismentul privind China a dus la temperarea așteptărilor pentru anul următor. Conducerea a declarat că nu se așteaptă ca veniturile din 2026 să scadă sub nivelul celor din 2025. Acest limbaj sugerează mai degrabă o plafonare a creșterii anul viitor, decât o accelerare, reflectând corecția anticipată din China și calendarul de implementare al noilor fabrici.

Concluzie

Rezultatele ASML din T3 2025 reconfirmă statutul companiei de cel mai important furnizor strategic din lanțul de aprovizionare al semiconductorilor. Impulsul puternic al comenzilor, determinat de cererea pentru AI, a reușit să compenseze îngrijorările legate de stagnarea veniturilor pe termen scurt și de scăderea marjei brute față de trimestrul precedent. ASML semnalează o tranziție a sursei sale de creștere către cursa de înarmare în AI. Cu toate acestea, avertismentul privind o “scădere semnificativă” a vânzărilor din China în 2026, din cauza restricțiilor, arată că drumul companiei către creștere se va plafona probabil anul viitor, înainte de a reaccelera.

Mereu să faci un calcul de fair value și nu uita că găsești un calculator gratuit din partea mea chiar pentru asta. Îl ai aici.

Ca de obicei, aș aprecia un share din partea ta!

Cum te poți proteja?

Piața poate deveni euforică foarte repede, dar euforia poate să atragă și volatilitate crescută. Cea mai bună metodă de a te proteja sunt ETF-urile și poți afla mai multe despre investițiile în ETF-uri din Master ebook-ul despre ETFs oferit gratuit de XTB România.

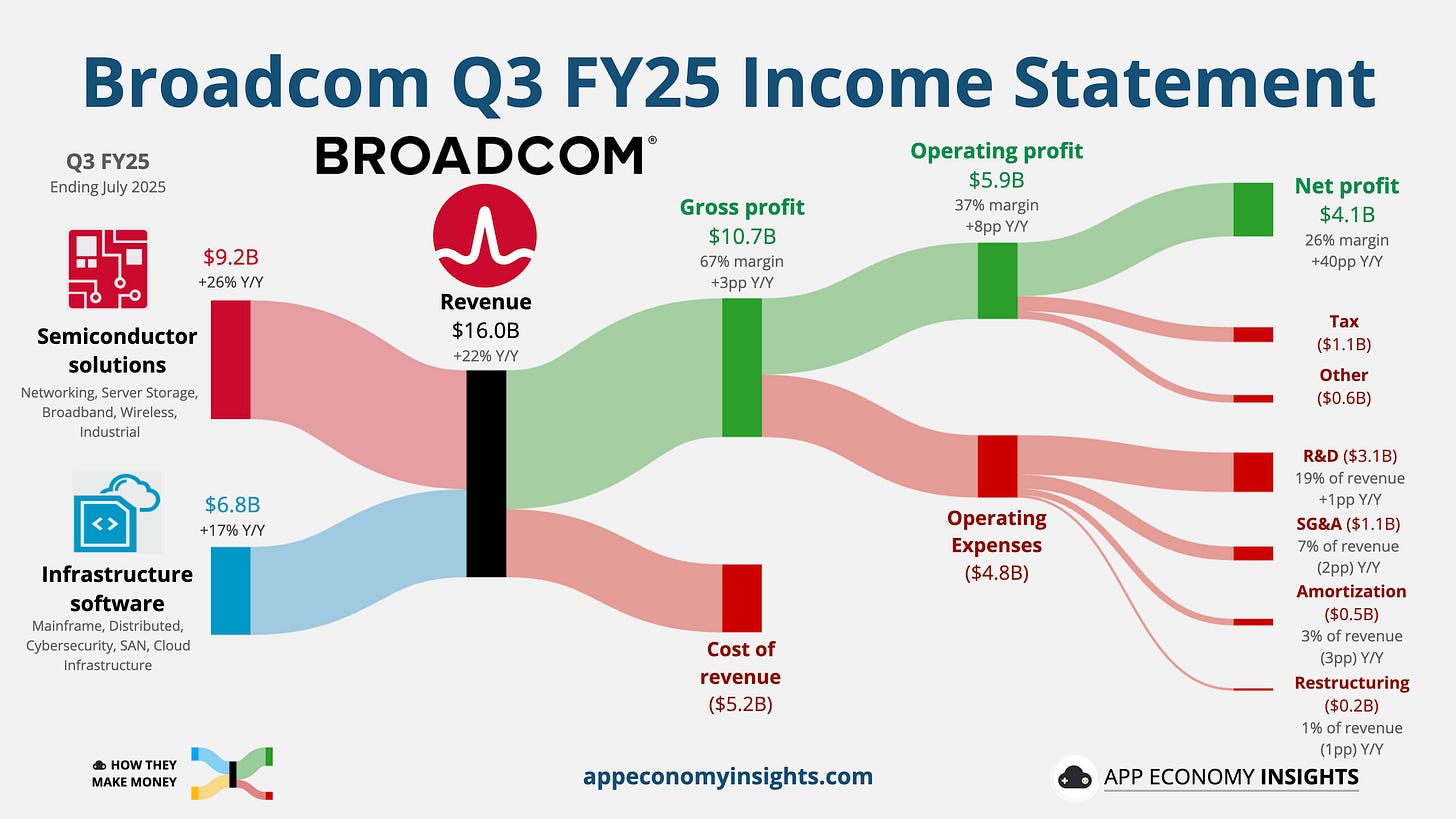

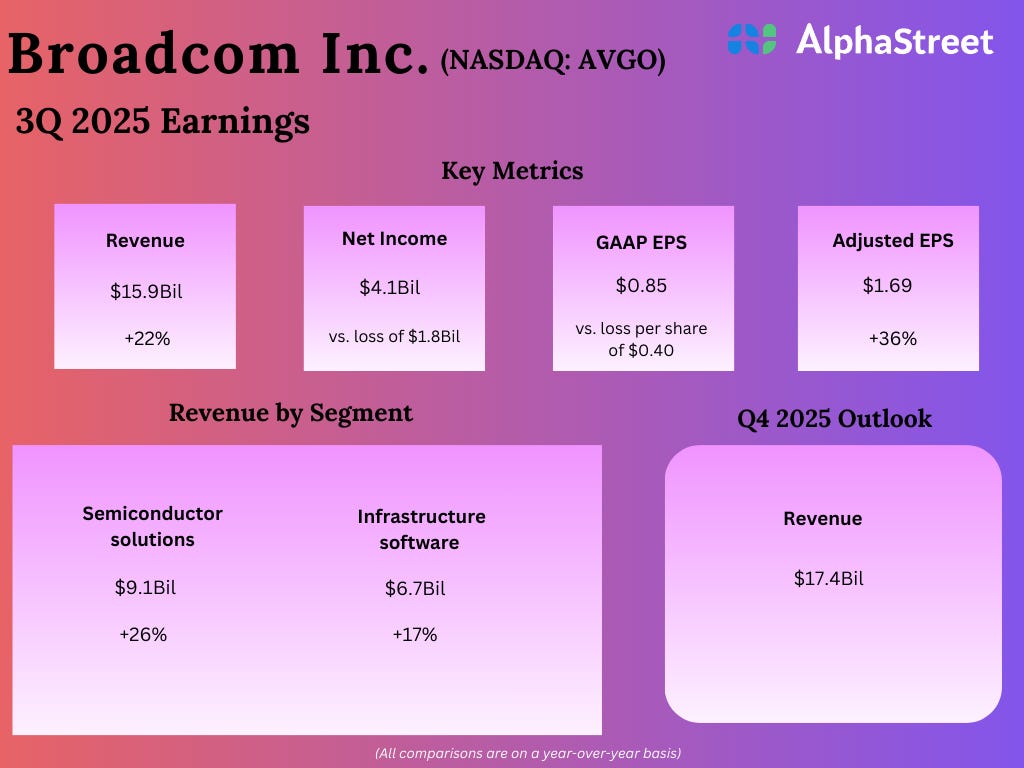

📊 Broadcom T3 2025 - Creșterea AI accelerează, parteneriatul cu OpenAI

Broadcom a raportat rezultate record pentru al treilea trimestru fiscal 2025 , determinate de o creștere continuă în acceleratoarele AI personalizate, rețelistică și VMware. Performanța solidă, care a dus acțiunile la niveluri record (o creștere de aproximativ 50% de la începutul anului), a fost amplificată de o veste strategică majoră: un nou parteneriat cu OpenAI. Creatorul ChatGPT se alătură listei de clienți hyperscale ai Broadcom (alături de Google, Meta și ByteDance) care caută alternative la GPU-urile costisitoare ale Nvidia. Această mișcare cimentează poziția Broadcom ca o ‘fortăreață’ defensivă în sectorul tehnologic, combinând puterea semiconductoarelor cu stabilitatea veniturilor din software

Rezultate financiare pe scurt

Venituri totale: 15,952 miliarde dolari , în creștere cu 22% față de anul precedent.

Venituri din soluții semiconductoare: 9,166 miliarde dolari , în creștere cu 26%.

Venituri din software de infrastructură: 6,786 miliarde dolari , în creștere cu 17%.

Venituri din AI (specifice): 5,2 miliarde dolari , în creștere cu 63% de la an la an.

Profit net (GAAP): 4,140 miliarde dolari.

Profit net (Non-GAAP): 8,404 miliarde dolari.

EPS diluat (GAAP): 0,85 dolari.

EPS diluat (Non-GAAP): 1,69 dolari.

Adjusted EBITDA: 10,702 miliarde dolari , reprezentând 67% din venituri.

Free cash flow: 7,024 miliarde dolari , reprezentând 44% din venituri.

Dividend: A fost aprobat un dividend trimestrial de 0,59 dolari pe acțiune

Puncte cheie

Accelerarea exponențială a AI Motorul principal al creșterii Broadcom este segmentul AI. CEO-ul Hock Tan a subliniat că veniturile din AI au accelerat la 5,2 miliarde dolari în T3, o creștere impresionantă de 63% de la an la an. Compania este extrem de optimistă în legătură cu acest segment, prognozând că veniturile din semiconductori AI vor accelera și mai mult în T4, ajungând la 6,2 miliarde dolari. Aceasta ar marca al unsprezecelea trimestru consecutiv de creștere, subliniind investițiile puternice și continue ale clienților în acest domeniu.

Parteneriatul strategic cu OpenAI Vestea care a captat atenția pieței este parteneriatul de peste 10 miliarde de dolari cu OpenAI. Acest acord prevede co-dezvoltarea primului accelerator AI intern al OpenAI, cu începere din 2026. Mișcarea este pivotală, deoarece validează strategia Broadcom de a oferi soluții personalizate (custom silicon) ca o alternativă viabilă și mai eficientă din punct de vedere al costurilor la dominația Nvidia. Asigurarea OpenAI ca client strategic, similar modului în care Broadcom a procedat cu Apple în domeniul wireless, blochează fluxuri de venituri viitoare și îi asigură un loc central în dezvoltarea infrastructurii AI.

Puterea segmentului de software (VMware) Dincolo de hardware-ul AI, segmentul de software de infrastructură continuă să fie un pilon de stabilitate și creștere. Acesta a generat venituri de 6,786 miliarde dolari, o creștere de 17%. Această bază mare de venituri recurente din software, consolidată de achiziția VMware, oferă companiei un flux de numerar constant și predictibil. Această divizie funcționează ca o componentă defensivă, oferind stabilitate financiară chiar dacă economia generală ar încetini.

Generare masivă de numerar și profitabilitate Performanța financiară a Broadcom este excepțional de robustă. Compania a generat un Free Cash Flow de 7,024 miliarde dolari (44% din venituri) și un Adjusted EBITDA de 10,7 miliarde dolari (67% din venituri). CFO-ul Kirsten Spears a subliniat că Adjusted EBITDA a crescut cu 30% de la an la an, reflectând o pârghie operațională puternică. Această generare masivă de numerar susține angajamentul companiei de a returna capitalul acționarilor, Broadcom returnând 2,8 miliarde dolari prin dividende în T3.

Perspective și avertismente

Broadcom a oferit o prognoză optimistă pentru trimestrul următor, așteptând venituri de aproximativ 17,4 miliarde dolari în T4 , ceea ce ar reprezenta o creștere de 24% față de anul precedent. Ghidajul pentru Adjusted EBITDA este menținut la un nivel impresionant de 67% din veniturile proiectate.

Parteneriatul cu OpenAI reprezintă un punct de inflexiune, care va accelera creșterea începând cu 2026. Broadcom demonstrează că strategia sa de a combina amploarea masivă cu parteneriate personalizate și profunde cu clienții dă roade. Prin provocarea directă a dominației Nvidia în AI și consolidarea bazei sale de software recurent, Broadcom își solidifică poziția nu doar ca un jucător critic în AI, ci și ca o investiție defensivă și extrem de profitabilă în sectorul tehnologic

Dacă vrei mai multe detalii despre investiții în companii faine, hai și tu pe Join - Youtube Membership aici. Costă mai puțin decât un pachet de țigări pe lună.

📩 Abonați-vă pentru mai multe analize financiare detaliate!

Pentru tot ce găsești aici și vrei să știi mai multe, urmărește-mă pe Youtube (un like și subscribe ca să pornim algoritmul)🎬 unde postez constant care să te ajute să fii mai profitabil și să ajungi la independență financiară mai rapid. 👇

Citatul ediției, ce părere ai?👇

„O investiție în cunoaștere aduce cea mai bună dobândă.” – Benjamin Franklin

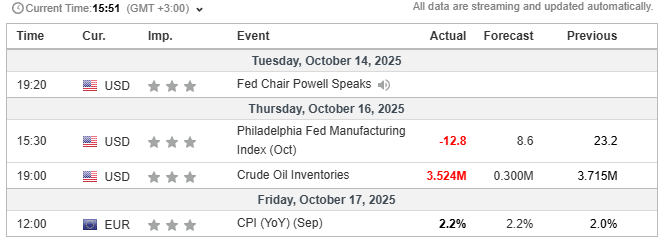

Ce urmărim în această săptămâmă 🗓️

Cele mai importante rapoarte din săptămână, știi exact când lumea s-ar putea să o ia razna și poți să îți explici de ce crește compania aia obscură de care nu ai mai auzit până acum.

Ai mai jos și datele de săptămâna trecută. (P.S. Ignoră culorile, nu sunt chiar corect evidențiate)

Sponsorul nostru de astăzi 👨💻

Astăzi vorbim despre Interactive Brokers 💼.

De ce Interactive Brokers 🤔

avem zona de research și discover🔍 unde putem să facem o analiză fundamentală detaliată📊

știri 📰 despre companii, atât pe telefon 📱, cât și pe versiunea browser 🌐.

poți să cumperi acțiuni 📈 cu deținere ca acționar 👩💼, nu custodie 🚫, nu CFD ❌, nu orice altceva ce încearcă alți brokeri să folosească ca să te atragă, numele tău e pe carnețelul companiei 📝!

poți să cumperi 🛍️ de la o multitudine de burse, nu doar NYSE, Nasdaq și câteva de prin Europa, dar ai China, Australia, Canada, Japonia, cam de pe oriunde și este singurul broker care îți dă această posibilitate 🚀

vrei să tranzacționezi în pre-market ⏰ sau after-hours 🌙? Da, poți printr-un singur click ✅, atât de ușor 👌.

vrei venit pasiv 💸 și ai o sumă mai mare de bani 💰? Ai Stock Yield Enhacement program (SYEP) 📈

poate îți place trading-ul, păi ai posibilitatea de a avea cont margin 😎 la Interactive Brokers și să îl legi de contul tău de TradingView 🔗, astfel vei putea executa ordine direct din TradingView 🖥️ și da, opțiunea e gratuită 🆓.

Ai cele mai mici costuri 💸 pentru că ei nu ai costuri ascunse 🕵️♂️ precum alții, știți ce comisioane plătiți și sunt mici, ultimul meu exemplu este 0.44$ pentru o investiție de aproximativ 1400$ 💰.

Poți să îți automatizezi investițiile cu doar câteva click-uri📊.

ai o garanție extinsă 🔒 de până la $100,000.00 pentru banii pe care îi ai neinvestiți 💼, iar acțiunile și ETF-urile tale sunt în siguranță pentru că ți-am zis, ești acționar, chillax 😎.

Vrei un ghid care să te ajute pas cu pas să îți faci un cont? Găsești aici.

Nu uita că te ajuți pe tine și sponsorizezi direct acest newsletter 📰 dacă pui banii la muncă încât să îți faci viața mai ușoară cu Interactive Brokers. Mă ajută enorm 🚀 să țin acest newsletter gratuit 🆓 și cât mai valoros pentru tine dacă arunci un ochi 👀 pe site-ul lor din link-ul de mai jos ⬇️ și dacă le dai o șansă 🎲 ca să te convingi că am dreptate. 👇

Doza de știri:📲

Știu, nu ai timp⏰, dar te ajut eu, nu trebuie să stai să cauți, să filtrezi, ai cele mai importante și relevante știri din săptămână ca să poți să te lauzi în fața prietenilor cu cât de informat ești tu.👨💻

😫 Pe fondul blocajului guvernamental prelungit, controlorii de trafic aerian continuă să lucreze, însă primesc doar plăți parțiale sau deloc, în ciuda importanței critice a muncii lor pentru siguranța zborurilor.

🤖 Piața muncii e tot mai competitivă, iar o poză de profil profesională face diferența. De aceea, observăm un val de headshot-uri generate de inteligența artificială, folosite intens pe LinkedIn și alte platforme de angajare, pentru a impresiona angajatorii.

📈 Gigantul tech chinez Alibaba investește zeci de miliarde în AI, într-un context de îngrijorare generală că multe companii cheltuie excesiv pe tehnologie cu rezultate limitate. Însă, Alibaba anunță că, în e-commerce, cheltuielile sale cu AI deja își acoperă costurile!

🚀 Anthropic a lansat Claude Haiku 4.5, un model AI mai mic și mai accesibil. Această lansare rapidă vine la doar câteva săptămâni după anunțul Claude Sonnet 4.5 din septembrie, evidențiind ritmul accelerat de inovație în domeniu.

🏎️ Apple și Formula 1 au semnat un acord media de 5 ani pentru SUA. Astfel, toate cursele televizate din F1 vor fi disponibile exclusiv pe platforma Apple TV, un parteneriat important pentru ambele părți și fanii motorsportului.

🚀 Apple a anunțat recent noi modele de MacBook Pro, iPad Pro și Vision Pro. Echipate cu cipul M5 actualizat, acestea promit performanțe mult mai rapide, oferind utilizatorilor o experiență îmbunătățită semnificativ față de versiunile anterioare.

💡 Honor lansează funcții AI ce oferă reduceri la cumpărături online! Honor, prin președintele de produse Fei Fang, anticipează o schimbare majoră: utilizatorii vor prefera asistenții AI în detrimentul aplicațiilor tradiționale de smartphone, conform unui interviu CNBC.

🏎️ Știri Financiare Apple: Compania este pe cale să anunțe un acord important de 140 de milioane de dolari anual pentru drepturile media F1 în SUA. În acest context, Eddy Cue de la Apple subliniază că serviciile de streaming sportiv necesită îmbunătățiri.

🛍️ Piața globală de modă și lux la mâna a doua ia un avânt extraordinar! De la circa 210 miliarde dolari în prezent, se estimează că va atinge un impresionant prag de 360 miliarde dolari până în 2030. Un trend pe care merită să-l urmărim!

📈 Miercuri, ASML, un jucător cheie în industria cipurilor, a calmat temerile privind creșterea sa în 2026. Comenzile au fost impulsionate de investițiile accelerate în inteligența artificială.

🚨 Alarmă în industria auto! Grupurile din sectorul auto trag un semnal de alarmă, deoarece China a înăsprit regulile de export pentru pământurile rare. Această decizie generează îngrijorare majoră, dată fiind dependența industriei de aceste resurse esențiale.

💰 Pentru Bank of America, ca și în cazul altor bănci importante, rezultatele solide din acest trimestru au fost propulsate de performanța puternică a diviziilor sale de pe Wall Street.

😟 Așteptam o perioadă mai liniștită a anului, dar tensiunile bancare și disputa comercială China-SUA agită piețele. Este doar o volatilitate tipică de octombrie sau ceva mai serios?

🤝 O veste importantă! Bessent și vicepremierul chinez se întâlnesc pentru a preîntâmpina o escaladare a tarifelor americane pe bunurile chinezești. Această întâlnire survine în contextul în care președintele Trump a declarat situația actuală ca fiind nesustenabilă. Obiectivul este clar: detensionarea situației comerciale.

🚀 Chiar și într-un an record pentru Wall Street, cu venituri uriașe din tranzacționare și investiții, marile bănci ca JPMorgan și Goldman Sachs angajează mai puțini oameni. Asta se întâmplă pentru că ele folosesc deja inteligența artificială (AI) în procesul de recrutare.

🚫 Vești proaste de la Washington: Senatul a respins propunerea de finanțare a armatei în timpul blocajului guvernamental, cu voturile democraților. Asta vine după ce, cu doar câteva ore înainte, nici proiectul de lege pentru finanțarea întregului guvern nu a trecut.

📈 BlackRock a identificat o oportunitate de valoare promițătoare într-un sector de nișă, mai puțin explorat, al obligațiunilor europene. Sunt optimiști și cred că investitorii pot profita acum de această piață financiară subestimată.

✈️ Boeing a livrat 55 de avioane în septembrie, un semn clar de stabilizare a producției. Astfel, compania este pe drumul cel bun să înregistreze cele mai multe livrări anuale din 2018.

🤔 Evaluări AI “Nebunești”? Ex-executivul Meta, Nick Clegg, subliniază că boom-ul AI a generat evaluări de piață “incredibile, chiar nebunești”. Acest climat de supraevaluare sugerează un risc ridicat de corecție iminentă, un aspect de urmărit îndeaproape.

⛏️ Săptămâna trecută, Beijingul a anunțat controale ample asupra metalelor rare. Această decizie a venit înaintea unei întâlniri anticipate între președinții Donald Trump și Xi Jinping, un eveniment cheie pentru relațiile bilaterale.

📉 Producătorul chinez de cipuri WingTech a înregistrat o scădere de 10% a acțiunilor sale, după ce guvernul olandez a preluat controlul subsidiarei Nexperia. Această decizie a fost luată pentru a garanta că produsele esențiale ale firmei rămân disponibile într-o situație de urgență, prevenind astfel posibile întreruperi în lanțul de aprovizionare.

🚫 China acționează! Ordinul a intrat în vigoare imediat, interzicând organizațiilor și indivizilor chinezi să desfășoare afaceri cu cele cinci subsidiare americane ale Hanwha Ocean. Această măsură restrictivă are un impact direct asupra operațiunilor și fluxurilor financiare.

⚠️ Atenție! Revenirea pieței din China ar putea întâmpina probleme. Tensiunile comerciale reînnoite dintre SUA și China amenință să spulbere optimismul investitorilor, pregătind o perioadă mai dificilă pentru piața asiatică.

🔄 Firmele chinezești se retrag de la IPO-uri în SUA, orientându-se spre Hong Kong. Tensiunile Beijing-Washington și reglementările americane mai stricte au dus la această schimbare, generând o creștere a listărilor în Hong Kong.

🤖 Parteneriatul Pony.ai și Stellantis demarează teste de robotaxi în Luxemburg în următoarele luni. Extinderea serviciului în alte țări europene este programată pentru anul viitor, marcând un pas important în mobilitatea viitorului european.

☕ Branduri de lux precum Louis Vuitton și Coach inovează. Ele deschid cafenele pentru a oferi clienților experiențe de lux accesibile, permițând oricui să guste din stilul de viață opulent la un preț mai mic.

🚨 Un atac cibernetic național-statal asupra firmei F5 a provocat scăderea acțiunilor cu 10%. Gravitatea situației a determinat CISA (Cybersecurity and Infrastructure Security Agency) să emită o directivă de urgență, semnalând riscuri semnificative pentru securitatea cibernetică.

🤔 În timp ce Spotify și Comcast au implementat recent structuri de co-CEO, cultura corporativă specifică și istoricul succesiunilor dificile de la Disney ar putea face o astfel de abordare mai puțin probabilă pentru viitorul lor.

📉 Acțiunile Eli Lilly și Novo Nordisk au scăzut semnificativ. Motivul? Declarația președintelui Trump că dorește un preț de 150 USD pentru medicamentele GLP-1, generând îngrijorare pe piață.

💰 Șefii de stat ai Uniunii Europene vor cere, la o întâlnire săptămâna viitoare, o acțiune mult mai rapidă pentru deblocarea activelor rusești înghețate. Scopul este finanțarea Ucrainei, conform unui document.

📈 La începutul lui 2024, după desprinderea unui panou de ușă de la un 737 Max 9 aproape nou, FAA a plafonat producția Boeing la 38 de avioane pe lună.

🚫 SUA a inițiat blocarea accesului uneia dintre cele mai mari companii de telefonie din Hong Kong la rețelele sale interne de telecomunicații, invocând motive de securitate națională.

🏦 Vești importante de la Rezerva Federală! Președintele Jerome Powell a anunțat că banca centrală se apropie de momentul în care va opri reducerea dimensiunii portofoliului său de obligațiuni. Această decizie semnalează că programul de înăsprire monetară se apropie de sfârșit și deschide drumul către posibile reduceri de dobândă.

💸 Franța a anulat reforma pensiilor din 2023, care ar fi crescut vârsta de pensionare de la 62 la 64 de ani. Deși a evitat o criză politică, această decizie crucială va costa milioane de euro.

⏸️ Premierul francez a suspendat temporar o reformă cheie a pensiilor din 2023. Această decizie, valabilă până după alegerile din 2027, vine în căutarea sprijinului pentru buget, oferind o pauză strategică.

🛡️ Piețele monetare au fost recent zdruncinate de o dispută comercială reaprinsă între SUA și China. Această incertitudine a condus la o tendință clară: investitorii, căutând siguranță pentru capitalul lor, s-au îndreptat masiv spre obligațiuni. Drept urmare, obligațiunile globale au înregistrat un raliu.

📉 GM va înregistra o cheltuială semnificativă de 1,6 miliarde de dolari, ca urmare a ajustărilor făcute planurilor sale pentru vehicule electrice. Această situație nu este singulară; rivalul Ford a raportat deja un impact similar de 1,9 miliarde de dolari acum mai bine de un an, subliniind provocările comune ale tranziției către EV.

💰 Google va investi 15 miliarde $ pentru un hub de centre de date AI în India. Acesta va fi cel mai mare al companiei în afara SUA, consolidând prezența sa tehnologică globală și capacitatea de inteligență artificială.

🚀 Johnson & Johnson a anunțat marți că va separa divizia sa de ortopedie într-o companie independentă. Noua entitate se va numi DePuy Synthes, marcând o importantă restructurare strategică pentru gigantul farmaceutic.

💰 Stellantis, părintele Jeep, își propune să investească 13 miliarde de dolari în fabricile auto din SUA în următorii patru ani. Această mișcare strategică vizează o redresare sub CEO Antonio Filosa.

📈 JPMorgan Chase a depășit estimările, cu venituri record din tranzacționare! CEO Jamie Dimon a declarat că, deși toate liniile de afaceri au performat excelent pe un fundal economic favorabil, banca se pregătește activ pentru posibile turbulențe viitoare.

🤠 Brandul de bijuterii Kendra Scott face pasul în lumea Western wear. Prin lansarea unei noi colecții de cizme, compania se alătură trendului actual, diversificându-și strategic portofoliul de produse.

🏗️ În mod surprinzător, propunerea Kremlinului către Elon Musk pentru un tunel Rusia-Alaska a venit pe fondul unor discuții importante între președinții Putin și Trump, care vizau găsirea unor soluții pentru încheierea războiului din Ucraina.

⚠️ Pe fondul recentelor turbulențe bancare, îngrijorarea crește. Împrumuturile private, mai puțin reglementate și transparente, ar putea crea riscuri semnificative pentru stabilitatea sistemului nostru financiar. Acesta este un aspect important de urmărit, dragi cititori!

🚀 LG Electronics India: Un Nou Jucător Pe Piața Indiană LG Electronics India este al doilea gigant sud-coreean care își face intrarea pe piața indiană în aproximativ un an, urmând exemplul Hyundai Motor India, listată în octombrie 2024. Această mișcare subliniază atractivitatea crescândă a Indiei pentru companiile asiatice majore.

⚡ Pentru un centru de date, securizarea terenului alimentat cu energie electrică necesită obținerea tuturor permiselor, angajamentelor ferme din partea furnizorilor de utilități și dezvoltarea infrastructurii esențiale pentru livrarea energiei. (37 de cuvinte)

💰 Băncile mari de pe Wall Street, precum Morgan Stanley și Goldman Sachs, se bucură de un mediu economic extrem de favorabil, perfect pentru a genera profituri substanțiale. Acest context le permite să obțină rezultate financiare remarcabile.

🛍️ Pentru retaileri, aceste constatări privind așteptările consumatorilor de prețuri mai mari și o economie mai slabă adaugă o notă de prudență perioadei cruciale de vânzări de sărbători, cea mai importantă a anului.

🚀 Nestle va reduce 16.000 de locuri de muncă. Această măsură vine pe fondul dorinței noului CEO, Philipp Navratil, de a accelera redresarea gigantului de bunuri de consum. Compania vizează o transformare rapidă.

🤝 Netflix și Spotify au anunțat un parteneriat strategic. Acesta va aduce podcasturi video, inclusiv cele de la The Ringer, pe platforma de streaming Netflix. O mișcare interesantă pe piața de conținut digital!

⚖️ Context: Fondul suveran de investiții din Singapore (GIC) a acuzat producătorul chinez de vehicule electrice Nio că ar fi indus în eroare investitorii. Conform unor documente depuse în instanță în august, Nio ar fi umflat veniturile.

📈 Nscale, compania de cloud AI, vizează o posibilă listare la bursă spre sfârșitul anului 2026. Această intenție a fost confirmată recent de un purtător de cuvânt pentru CNBC, marcând o mutare importantă pe piața tehnologică.

💰 Mega-tranzacție de 40 miliarde dolari! MGX, Global Infrastructure Partners de la BlackRock și parteneri cheie din Artificial Intelligence Infrastructure Partnership (incluzând Nvidia, Microsoft, xAI) achiziționează Aligned Data Centers. Această mișcare strategică consolidează infrastructura AI globală.

🔞 ChatGPT de la OpenAI va permite în curând adulților acces la o versiune mai puțin cenzurată, incluzând materiale erotice, a declarat CEO-ul Sam Altman. Aceasta marchează o schimbare semnificativă pentru platformă.

🚀 Oracle Cloud Infrastructure a anunțat că va implementa 50.000 de cipuri AI de la Advanced Micro Devices (AMD), începând cu a doua jumătate a anului 2026. Această mișcare marchează un pas important în peisajul concurențial al cipurilor AI.

🤯 Paxos, partenerul cripto al PayPal, a emis din greșeală o sumă astronomică de 300 trilioane dolari în stablecoins, într-o “eroare tehnică” majoră. O greșeală cu adevărat spectaculoasă, nu-i așa?

💰 SoftBank pregătește listarea PayPay, aplicația japoneză de plăți. Investitorii anticipează o evaluare de peste 20 miliarde dolari la IPO-ul său, pe măsură ce compania se pregătește să intre pe bursă.

📈 Retailerii precum Target și Walmart, alături de magazinele mici, înregistrează vânzări crescute grație boom-ului cărților de colecție Pokémon și sport, o tendință benefică înaintea sezonului sărbătorilor.

📉 Economia Elveției se confruntă cu riscuri tot mai mari. Mărfurile sale sunt lovite de tarifele punitive impuse de administrația Trump, ceea ce pune o presiune considerabilă asupra stabilității economice a țării.

📉 Zions Bancorporation a suferit o lovitură uriașă, pierzând 1 miliard de dolari din valoare într-o singură zi, joi. Motivul? Dezvăluirea a 60 de milioane de dolari în credite acordate, considerate acum improbabile de a fi recuperate. O veste ce a speriat Wall Street-ul!

💧 Europa plănuiește să-și tripleze capacitatea centrelor de date pentru a deveni un hub AI global. Însă, aceste megaproiecte AI, mari consumatoare de apă, generează deja îngrijorări serioase în cele mai aride regiuni europene.

🛡️ John Burrello, manager de portofoliu la Invesco, subliniază că fondurile de venit ce folosesc strategii bazate pe opțiuni reprezintă o abordare potrivită. O soluție interesantă pe care merită să o explorăm!

🏭 Veste bună de la Walmart! CEO-ul John Furner anunță că retailerul își mărește semnificativ investițiile în produse fabricate în SUA și în furnizorii locali. Aceasta este o prioritate strategică, semnalând un reviriment al producției americane și oportunități de afaceri solide.

🛡️ Secretarul Trezoreriei, Scott Bessent, insistă că SUA nu își va schimba poziția de negociere față de China, chiar dacă piețele bursiere sunt volatile. Deciziile politice nu depind de oscilațiile bursei, subliniind o abordare fermă.

📈 Trump, în acțiune pe frontul ucrainean! Săptămâna aceasta, fostul președinte a declarat că ia în considerare trimiterea de rachete Tomahawk către Ucraina, pentru a crește presiunea asupra Rusiei și a forța încheierea conflictului. Mai mult, Trump a anunțat că el și Putin se vor întâlni în Ungaria, tot pentru a discuta războiul din Ucraina.

⛽ Trump a declarat că Washingtonul este nemulțumit de achizițiile de țiței rusesc ale Indiei. Motivul: acestea permit Moscovei să își continue “războiul ridicol” în Ucraina, o preocupare majoră pentru SUA.

🚧 Președintele Trump a anunțat încheierea războiului dintre Israel și Hamas. Totuși, experții avertizează că procesul de pace abia începe, fiind un drum lung și fragil în Orientul Mijlociu. Este o situație de monitorizat cu atenție.

📈 Veste bună de la TSMC! Compania a raportat un profit record în trimestrul al treilea, în creștere cu 39,1%. Chiar dacă a ratat estimările inițiale, acest rezultat impresionant marchează un nou vârf pentru gigantul producător de cipuri.

🤔 Guvernul federal american a înregistrat un deficit de 1,78 trilioane dolari, cu 41 de miliarde de dolari (2,2%) mai puțin decât în anul fiscal 2024. O reducere, dar tot o sumă colosală.

🤔 Economia Marii Britanii încetinește, iar asta nu e o surpriză. Economiștii au prognozat o moderare a activității economice pentru acest an, deci situația actuală era, de fapt, anticipată.

📉 Vestas și-a suspendat planurile pentru fabrica de pale eoliene din Polonia, ce urma să creeze peste 1.000 de locuri de muncă și să înceapă producția în 2026, din cauza cererii scăzute în Europa.

🛍️ Walmart își unește forțele cu OpenAI! Gigantul retail va permite achiziții directe în ChatGPT, o mutare strategică. Această inițiativă subliniază efortul Walmart de a ține pasul cu noile moduri prin care clienții descoperă și interacționează cu produsele, adaptându-se rapid la piața digitală în continuă schimbare.

😲 Reacția bursei la știrile din această săptămână 📰, 📈 ce a urcat ⬆️ și 📉 ce a luat-o la vale ⤵️.

Zions

🏦 ⬆️ +1%

Acțiunile băncii regionale au crescut cu peste 1%, contribuind la revenirea subsectorului bancar regional. Creșterea a fost determinată de îmbunătățirea ratingului de către Baird, indicând o reevaluare pozitivă a perspectivei financiare a companiei.

Western Alliance

💰 ⬆️ +1% (sub 1%)

Acțiunile băncii au crescut cu puțin sub 1%, alăturându-se revenirii sectorului bancar regional. Avansul a contribuit la creșterea generală a ETF-ului SPDR S&P Regional Banking (KRE), care a crescut cu 0.4%.

Oracle

☁️ ⬇️ -2.4%

Acțiunile companiei de software au scăzut cu 2.4%, cedând o parte din câștigurile sesiunii precedente. Declinul vine la o zi după ce Oracle a confirmat un acord de cloud computing cu Meta, stârnind dezbateri printre investitori.

Micron Technology

💾 ⬇️ -1.8%

Acțiunile au scăzut cu 1.8% după ce Reuters a raportat, citând surse, că Micron ar urma să părăsească afacerea cu cipuri de server din China. Decizia vine pe fondul nerecuperării afacerilor după interdicția din 2023 asupra produselor sale.

Warner Bros. Discovery

📺 ⬆️ +4%

Compania a crescut cu peste 4% după ce Bloomberg News a raportat că a respins oferta de preluare a Paramount Skydance (aproximativ $20 pe acțiune). Se anticipează o ofertă mai mare sau o mutare ostilă din partea pretendentului.

Bloom Energy

⚡ ⬆️ +26%

Acțiunile au urcat cu 26% după ce producătorul de generatoare de celule de combustibil a încheiat un parteneriat de 5 miliarde de dolari cu Brookfield Asset Management. Acordul vizează instalarea de celule de combustibil în centrele de date pentru inteligență artificială.

Shake Shack

🍔 ⬆️ +2%

Lanțul de burgeri a adăugat 2% după ce Jefferies a îmbunătățit ratingul la “menținere” de la “subperformant”. Firma a declarat că riscul-recompensă este acum mai echilibrat, în urma unei scăderi recente a prețului acțiunilor.

Estee Lauder

💄 ⬆️ +4%

Producătorul de cosmetice a crescut cu 4% după ce Goldman Sachs a îmbunătățit ratingul la “cumpărare”, estimând un potențial de creștere de 30%. Banca a menționat că acțiunile se apropie de un punct de inflexiune fundamental.

Rocket Lab

🚀 ⬆️ +6% (aproape 6%)

Compania de rachete a sărit cu aproape 6% după ce Morgan Stanley a majorat prețul țintă la un nivel record pentru piață. Firma a indicat că lansarea inițială a programului Neutron este următorul catalizator major pentru acțiuni.

USA Rare Earth

💎 ⬆️ +18% (peste 18%)

Acțiunile au crescut cu peste 18% pe fondul raliului minerilor americani de metale rare. Creșterea a fost declanșată de amenințările de retorsiune ale președintelui Trump la adresa Chinei, privind controalele stricte la export.

Critical Metals

⛏️ ⬆️ +18%

Acțiunile au crescut cu 18%, urmând trendul pozitiv al sectorului de minerale rare din SUA. Creșterea a fost un răspuns direct la tensiunile comerciale și la dorința administrației Trump de a contracara controlul Chinei asupra acestor resurse.

Energy Fuels

☢️ ⬆️ +11% (peste 11%)

Compania a sărit cu peste 11% în contextul raliului acțiunilor de metale rare. Măsurile amenințate de Trump împotriva Chinei au stimulat încrederea în producătorii autohtoni de resurse critice.

MP Materials

🪙 ⬆️ +8% (aproximativ 8%)

Acțiunile companiei au urcat cu aproximativ 8% pe măsură ce acțiunile de metale rare au crescut. Această mișcare este o reacție la escaladarea tensiunilor comerciale și la potențialele politici de sprijinire a producției interne de minerale critice.

JPMorgan Chase

🏦 ⬆️ +0.2%

Acțiunile au crescut ușor cu 0.2% după ce rezultatele companiei au depășit estimările analiștilor. Venitul din tranzacționare a atins un record de aproape 9 miliarde de dolari, demonstrând o performanță robustă a băncii de investiții.

Goldman Sachs

📊 ⬇️ -0.3%

Banca de investiții a scăzut cu 0.3% în ciuda faptului că a depășit estimările Wall Street. Goldman a raportat un câștig de $12.25 pe acțiune și venituri de $15.2 miliarde, susținute de o activitate mai bună de investment banking și tranzacționare de obligațiuni.

Wells Fargo

📈 ⬆️ +2.5%

Rezultatele financiare din trimestrul al treilea au depășit așteptările, trimițând acțiunile în creștere cu 2.5%. Compania a raportat un câștig de $1.66 pe acțiune, peste estimările de $1.55, și și-a majorat ținta de profitabilitate.

BlackRock

🏛️ ⬇️ -0.3%

Managerul de active a scăzut ușor cu 0.3% în ciuda rezultatelor din trimestrul al treilea care au fost mai bune decât se aștepta. BlackRock a raportat $11.55 pe acțiune (excluzând elementele excepționale) pe venituri de $6.51 miliarde.

Citigroup

💰 ⬆️ +0.3%

Acțiunile au crescut cu 0.3% după ce compania a raportat un câștig de $1.86 pe acțiune în trimestrul al treilea, depășind estimările de $1.73. Veniturile de $22.09 miliarde au depășit, de asemenea, consensul pieței.

Johnson & Johnson (J&J)

💊 ⬆️ +0.2%

J&J a câștigat 0.2% după ce a raportat un câștig ajustat de $2.80 pe acțiune și venituri de $23.99 miliarde în trimestrul al treilea, depășind estimările analiștilor.

General Motors (GM)

🚗 ⬇️ -1.7%

Producătorul auto a scăzut cu 1.7% după ce a anunțat că rezultatele sale din trimestrul al treilea vor include o cheltuială de 1.6 miliarde de dolari din cauza reducerii ambițiilor sale în domeniul vehiculelor electrice.

Ford Motor

🚚 ⬇️ -5%

Acțiunile au scăzut cu 5% în urma unui raport din Wall Street Journal conform căruia un incendiu la un furnizor de aluminiu a oprit temporar producția a cel puțin cinci modele, inclusiv F-series.

Arm Holdings

💡 ⬆️ +2% (aproape 2%)

Designerul britanic de semiconductori a adăugat aproape 2% după ce The Information a raportat că OpenAI colaborează cu Arm pentru a dezvolta o unitate centrală de procesare personalizată.

Robinhood Markets

📈 ⬇️ -2%

Platforma de tranzacționare a scăzut cu 2% după ce Reuters a raportat că Robinhood este deschisă la tranzacții pentru a-și extinde afacerea cu piețele de predicții.

De unde știu eu de toate acestea? De aici.

Calendarul raportărilor pentru această săptămână 📬

Aici afli ce companii raportează, dar ne uităm doar la cele mari și importante. Lasă un comentariu cu ce companii urmărești și tu!

Poți să consulți calendar de mai jos, pe cel de pe XTB, IBKR sau să îl folosești pe cel de pe FinChat.io.

Dacă vrei și un calendar economic gratuit care te lasă să îți adaugi în Google Calendar, iOS Calendar etc toate evenimentele, tot pe Interactive Brokers găsești ce cauți. Ți-am zis, ai totul acolo, e no-brainer!👇

Ne revedem și săptămâna viitoare cu o noua ediție a newsletter-ului. Fiindcă suntem la început este posibil să mai sufere modificări, însă putem să mergem doar în sus de aici.

P.S. Sorry dacă mai găsiți typos, dar e un one man show și se întâmplă și la case mai mari.

Disclaimer! Acest newsletter este doar cu caracter informativ și nicio informație prezentată nu trebuie tratată drept consultanță financiară.

🔗 Link-urile de afiliere care pun pâinea 🍞 pe masă. Mulțumesc! 🙌

📈 XTB, broker cu prezență în România și suport în limba română. Link aici.

📈 INTERACTIVE BROKERS, brokerul pentru orice investitor la bursă! Link aici.

💻 Finchat.io - ChatGPT al investitorilor. Primești din partea mea o reducere de 15% dacă folosești acest link de aici.

🔒 BEST VPN, Surfshark, îl folosesc de peste 4 ani și nu regret nici măcar un moment, link aici.

🔒 Incogni, securizează-ți datele și ia-le din mana brokerilor de date, link aici.

📊 BONUS 30$ reducere Tradingview, link aici.

🔐 NANO LEDGER, ține cripto în siguranță! Link aici.

Recomandări newsletter🙌:

Excellent comprehensive analysis of TSMC Q3 results! The detail on how N3 and N5 combined for 60% of wafer revenue really highlights their technology lead. What's particulary striking is the flat HPC revenue QoQ despite all the AI hype - that's the kind of datapoint that deserves more scrutiny given management's confidence about AI demand sustainability. Also the overseas fab dilution persisting at 2-3% for years is significant, it's basically permanent margin compression for geopolitical insurance that investors often underestimate. The exponential token growth metric Wei mentioned is facinating too, because if workload demand is doubling every 3 months but HPC revenue is flat, something has to give - either pricing or utilisation. Overall, TSMC remains the most critical choke point in global tech infrastrucure.